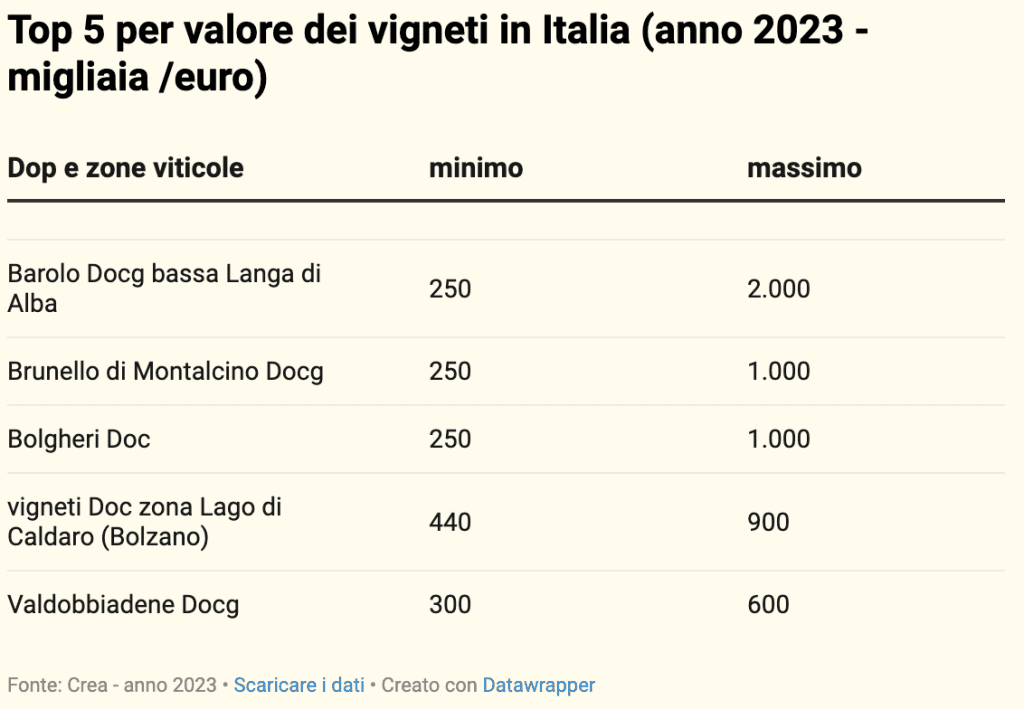

Up to two million euros for a hectare of vineyard in Piedmont to produce Barolo DOCG, one million euros for Brunello di Montalcino and the prestigious Bolgheri DOC in Tuscany, around 900,000 euros for vineyard land under DOC in the Alto Adige area around Lake Caldaro, 600,000 euros for a vineyard in the Prosecco hills for DOCG Conegliano Valdobbiadene wines, up to 100,000 euros for the emerging DOC Etna area in Sicily, and 140,000 for terraced vineyards on the island of Pantelleria. Italy's agricultural land market favours high-quality areas, particularly in the wine sector, and focuses on the most renowned wines. This is especially true for those from Central and Northern Italy, which attract investment more successfully than other parts of the country.

Wine valuations outperform the rest of agriculture

The picture emerging from the latest Crea report (Survey on the Land Market) indicates that the wine sector is doing somewhat better than most other agricultural segments, though the overall context remains challenging. On the one hand, prestigious areas seem to be on a relatively steady path; on the other, agriculture as a whole is moving at varying speeds depending on the segment in question, whether it's olive growing, cereal farming, or floriculture. High- and ultra-high-quality wine remains in demand, with prices generally holding up. However, the market can't be described as highly dynamic. What concerns analysts more is the trend towards the erosion of land's real value.

Alto Adige vineyards

Winners and losers

Comparing vineyard prices per hectare in 2023 with 2022, there's a general stability, with slight upward adjustments in maximum values, for example in the DOC vineyard areas around Gattinara, Piedmont (from €95,000 to €100,000 per hectare), and in the Friuli Colli Orientali region (from €100,000 to €110,000). Barolo, according to "list prices," can reach up to €2 million, although recent transactions have seen even higher figures, sometimes double that.

Among emerging wine-growing areas, characterised by "heroic" viticulture, there’s a notable 13% increase in the Chambave DOC zone in Valle d'Aosta, with maximum per-hectare values rising from €150,000 to €170,000. This niche area is gaining importance, partly due to recognition in the Gambero Rosso's Italian Wines Guide, which in its 2025 edition highlighted the area's high quality. In Emilia Romagna, prices are mostly stable, with a slight drop for mechanised vineyards in Modena province (from €85,000 to €80,000). Meanwhile, in Tuscany, vineyard prices for Brunello di Montalcino rose from €900,000 in 2022 to €1 million per hectare in 2023, and DOC Bolgheri vineyards increased from €700,000 to €1 million per hectare. In Tuscany, an hectare of vineyard for Rosso di Montalcino is now valued at €200,000, almost the same as Chianti Classico in the province of Florence (€210,000).

In Umbria, there's a slight decrease for Montefalco DOC (from €48,000 to €46,000 per hectare); in Lazio, Castelli Romani DOC remains stable at €100,000; in Abruzzo, slight increases are noted for DOC vineyards in the hills of Chieti, Ortona, and Roseto degli Abruzzi (from €60,000 to €65,000); in Campania, minimum prices for a hectare of DOC vineyards in the Calore hills, Avellino, and central Irpinia rose by about 15% from 2022 to 2023, including the Galluccio area in Caserta. In Puglia, there's a small drop for DOC Manduria vineyards (from €37,000 to €35,000 at maximum values and from €23,000 to €21,000 at minimum values per hectare). In Sicily, Etna DOC vineyards saw an increase, with minimum prices rising from €43,000 to €45,000 and maximum prices from €90,000 to €95,000 per hectare. In Sardinia, there were slight upward adjustments for DOC vineyards in Parteolla and for Vermentino di Gallura DOCG.

Agricultural land values up by just 1% compared to 2022

Looking at agricultural land in general, in Italy, during 2023, the average price (including vineyards) increased by 1% compared to 2022. This signals a "static land market," writes Crea, "with no major changes in the prices of the main crop types." The average price per hectare recorded is around €22,800. Across different regions, average per-hectare values continue to show significant differences. The highest value (€47,000) is in the North-East, followed by the North-West (€37,000, +3%), while much lower values are seen in the Centre and South, averaging below €16,000. "More transactions occur in agricultural areas with higher crop profitability, particularly in the wine and fruit-growing regions of the North," the report states, "unlike in inland and mountainous areas, where the supply of land does not match market demand."

Static market and uncertainties

International uncertainty and extreme climate variability discouraged agricultural land purchases throughout 2023 in Italy, according to the Crea policy and bioeconomy study (supported by Conaf). International turmoil has driven up production costs, and profitability has fallen, putting less structured companies in difficulty. What are the effects on the land market? According to Andrea Arzeni (Crea-Pb), there’s been "an increase in the supply of marginal land," especially in inland areas, while demand has grown slightly for land suited to quality production. Considering the economic uncertainty over the medium and long term and anticipation of new opportunities from the 2023-2027 Strategic Plan of the CAP, the volume of land transactions in 2023 "was limited, with farmers preferring to lease land instead."

Leasing preferred over purchase

The high risk of investing in agriculture in an uncertain economic environment has made leasing more attractive than buying land. This trend has been long-term. In Italy, the amount of agricultural land under lease (6.2 million hectares) has more than doubled over the past 30 years, with a 27% increase in the last decade, according to Crea. The average farm size has also increased (over 11 hectares), reinforcing this trend. Farms have grown through consolidation and leasing. "The decline in farms," writes Davide Longhitano (Crea-Pb), referring to 2020 Istat census data, "has mainly affected those with only owned land, while farms with only leased land have increased."

Demand outstrips supply in the North

What happened in 2023? In northern Italy, demand for leased land exceeded supply, increasing the number of contracts and the land area rented, especially for high-value crops. In the wine sector, notable figures include €3,000 per hectare annually for Moscato d'Asti vineyards, €8,000 for DOCG Valdobbiadene vineyards, and €7,000 for those in Castagneto Carducci (Bolgheri DOC). In general, rent prices remained stable, while demand increased among young farmers setting up for the first time and due to drought, which forced businesses to lease more land to compensate for production losses. In central Italy, many small farms were driven by economic hardship to either close or seek land for rent, given the difficulty of buying at high prices. Here too, rents remained stable, with a preference for short-term leases. In southern Italy, the volume of leases in 2023 remained stable, with supply outstripping demand, especially in inland areas, and rents unchanged. Some minimum rents are relatively low, such as €600 annually for vineyards in the Vermentino di Gallura DOCG, €1,100 for vineyards in the Salice Salentino DOC, and €650 annually for vineyards in the hills of the province of Campobasso.

Buyers and sellers

Who are the buyers and sellers? According to Crea's report, buyers are mainly farmers looking to expand their cultivated land. Alongside them are non-agricultural operators, private individuals seeking low-risk investments "even if not very profitable." As for sellers, they are primarily farmers winding down their activities, followed by private landowners, often heirs to land who are uninterested in farming. In general, land sales are mediated by a sector professional, although, as Crea notes, it's still common for agreements to be made without intermediaries. Regarding the use of land for renewable energy production, interest is described as "sporadic but growing."

Inflation effect, scarce liquidity, and loss of real value

Inflation and difficulties in accessing credit are among the factors, according to Crea, contributing to the slight overall decline in non-buildable agricultural land purchased in 2023 in Italy, as highlighted by data from the Real Estate Observatory. These data show that last year's trend reversed the recovery seen in 2022 and 2021, the post-pandemic years. Banca d'Italia data for 2023 also indicate the difficulty of obtaining liquidity for agricultural investments. Loans in 2023 fell by 19% compared to 2022, to €280 million, down from €340 million the previous year. As for inflation, while the annual rate dropped from 8.1% in 2022 to 5.4% in 2023, "the slight increase in land prices did not prevent the erosion of real values. This loss of value, combined with the generally low profitability of agricultural production," Crea writes, "discourages those not interested in making land investments or unable or unwilling to change their production model."

Women are the best sommeliers. Here are the scientific studies

Women are the best sommeliers. Here are the scientific studies Where to eat at a farm stay in Sicily: the best addresses in the Provinces of Trapani, Palermo, and Agrigento

Where to eat at a farm stay in Sicily: the best addresses in the Provinces of Trapani, Palermo, and Agrigento Wine in cans, bottle-fermented, and alcohol free: the unstoppable change in Gen Z’s tastes

Wine in cans, bottle-fermented, and alcohol free: the unstoppable change in Gen Z’s tastes The great Bordeaux exodus of Chinese entrepreneurs: around fifty Châteaux up for sale

The great Bordeaux exodus of Chinese entrepreneurs: around fifty Châteaux up for sale Dubai speaks Italian: a journey through the Emirate's best Italian restaurants

Dubai speaks Italian: a journey through the Emirate's best Italian restaurants