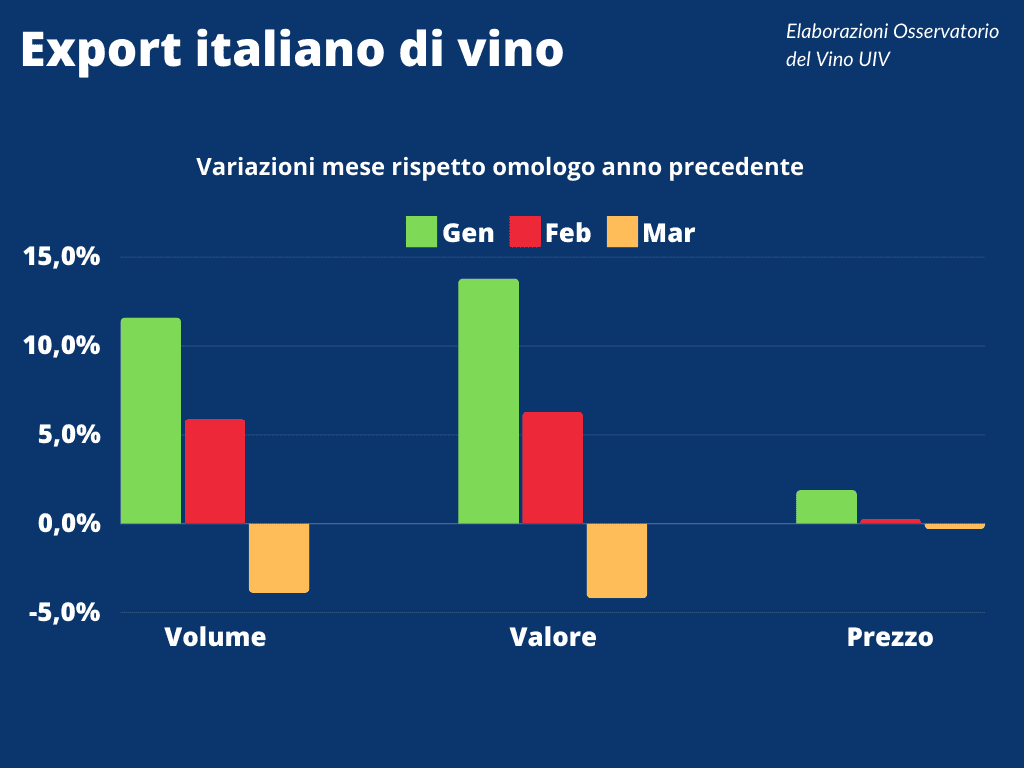

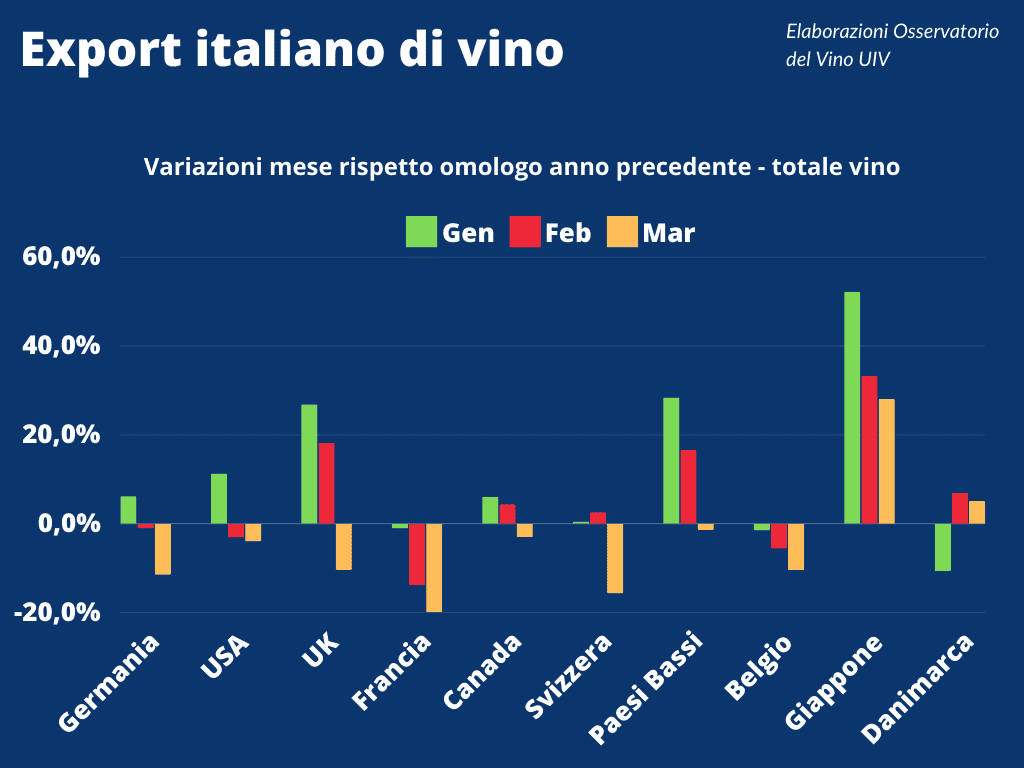

March was challenging for Italian wine abroad. While the first quarter ended on a positive note (+3.1% in volumes and +3.9% in values, according to the latest Istat data), the third month of the year, according to UIV Wine Observatory revisions, recorded a trend reversal with a 4% gap due mainly to double-digit declines in Germany, the United Kingdom, Switzerland, and France. And while all types posted positive value balances – with sparkling wines at +7.3% since January, bottled still wines at +2.7%, and sparkling wines at +12.2% – average prices (except for bulk wines and musts) still lost their sheen, indicating that the market is not willing to pay more to compensate for a notably light last harvest in terms of production.

Stockpiling Italian wine in Russia

The increase in exported volumes – according to UIV analysis – is entirely attributed to the surge in orders from the Russian Federation, without which growth would have been flat. In terms of values, Russia also recorded a +142.6% in the quarter, rising to sixth place and surpassing France and Japan. The reason is clear: the Russian excise duties introduced last May on alcoholic beverages (excluding vodka), which prompted a pre-emptive rush to stock up. Thus, while the quarter can count on this lifeline, the subsequent months will face a completely different situation, especially considering that the excise duties will intersect with new tariffs, which from August are expected to increase from 12.4% to 20% on wine imports from countries perceived as hostile, including the United States and European countries.

Italy better than France

Among the positive notes of the quarter, in this ping-pong of lights and shadows, there is certainly the return to positive figures for bottled PDO reds (+2.8% in value, to 459 million euros), the double-digit increase in PGI whites (+12.7%), the surge of Prosecco (+7.8%) and Asti DOCG (+7.5%) among sparkling wines, and a better performance compared to French competitors, who stopped at -0.2%.

"The current economic context still requires the utmost attention," commented the president of the Italian Wine Union, Lamberto Frescobaldi. "We believe that in this very fluid phase it is particularly important for companies to continue monitoring the markets but also to keep an eye on price lists, because the long-term goal remains to improve the positioning of Italian-made wine. At the same time, UIV is convinced that even in complicated phases like this, it is necessary not to abandon the path of strategic investments in promotion, innovation, and vineyard restructuring."

The best Street Food in Italy according to Gambero Rosso

The best Street Food in Italy according to Gambero Rosso The best Arrosticini in Italy are made inside a Fiat 500

The best Arrosticini in Italy are made inside a Fiat 500 In Civitavecchia, there's a hidden restaurant inside a petrol station where Judges and Lawyers have lunch

In Civitavecchia, there's a hidden restaurant inside a petrol station where Judges and Lawyers have lunch The best extra virgin olive oils from Lazio chosen by Gambero Rosso

The best extra virgin olive oils from Lazio chosen by Gambero Rosso Where to eat on a terrace in the Langhe: 3 restaurants with vineyard views in Monforte d'Alba

Where to eat on a terrace in the Langhe: 3 restaurants with vineyard views in Monforte d'Alba