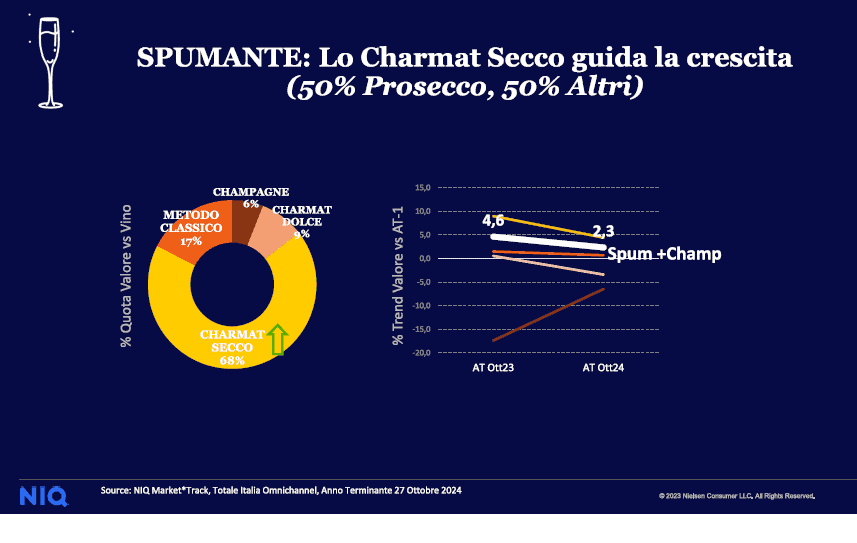

Sparkling wines have overtaken still wines in out-of-home consumption by Italians. This was revealed by a study presented by the Uiv Observatory and Niq Italia during the Simei (the wine technology fair currently underway in Milan). A historic and unexpected shift, considering that still and sparkling wines have always formed the backbone of Italy’s vineyards, accounting for around 80% of production. Now, however, the panel surveyed by Nielsen Italia shows that 63.4% of consumers prefer sparkling wines, while 61% favour still wines. Specifically, dry Charmat wines lead the growth (68%, half of which is Prosecco), followed by Classic Method (17%), sweet Charmat (9%), and Champagne (6%).

Wine consumption more and more linked to the aperitif

The rise of sparkling wines reflects broader changes in consumption patterns, particularly with the aperitif becoming the dominant occasion for alcoholic drinks, at the expense of main meals. Surprisingly, these shifting habits aren't just seen among Gen Z or Millennials, but also across other age groups: 45-54-year-olds (with both aperitifs and meals at 31%) and over 55s are increasingly drawn to this trend.

Growing interest in mixology

Alongside the increasing consumption of sparkling wines, cocktail consumption is also on the rise, growing in parallel with the use of social media. In fact, 37% of consumers state that they choose cocktails based on their photogenic qualities for social media. Among the top 10 cocktails consumed in the horeca (hotel, restaurant, café) sector, four contain sparkling wine, with three of them being spritzes. The Hugo cocktail, in particular, is very popular with the 18-24 age group, providing an opportunity to engage with a demographic that shows low affinity for wine.

“We are witnessing,” said Carlo Flamini, head of the Uiv Observatory, “a revolution in consumption that is accelerating for several reasons. It’s crucial to embrace change to activate generational turnover: over the next 20 years, there will be 400 million young consumers globally, with whom wine must engage to become part of the experience, not just the protagonist.”

![]()

At-Home consumption favors still wines

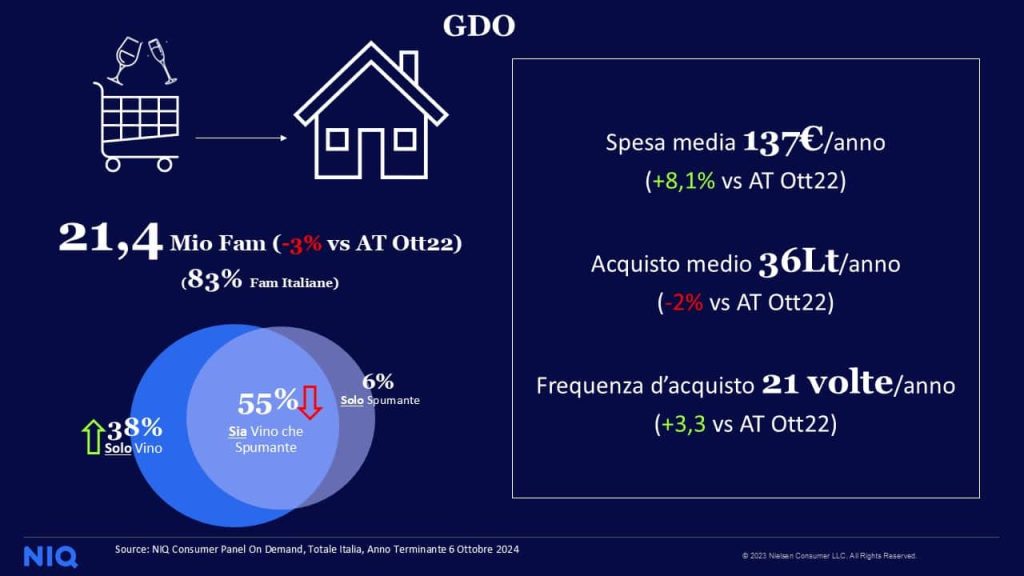

While sparkling wines (and cocktails) dominate out-of-home consumption, the domestic market shows a clear preference for still and frizzante wines (93%) over sparkling wines (61%). The primary consumers are over 55s, often with no dependent children at home and, in most cases (6 out of 10), with an income above the national average. This group represents an estimated 11.3 million households, accounting for 59% of total spending in large-scale distribution and domestic wine sales. The Baby Boomers (with a slight overlap into Generation X) represent a market worth €1.83 billion annually. In contrast, families with children (7.8 million households) account for less than 24% of the total spend, while under-55s without children represent less than 18%.

Families with children spend less on wine

“We are seeing a trend that’s becoming increasingly evident,” notes Eleonora Formisano from NIQ Italia. “The first group is growing significantly, while the others are struggling, particularly lower-income segments. There’s a polarisation in wine consumption based on structural factors such as age and disposable income.” It’s the average annual spend that makes the difference, highlighting the struggle of Italians who, in general, have increased their purchase frequency (+3.3%) to alleviate the sense of expense, but have reduced wine consumption (-2%). Specifically, families with children spend on average five times less on beverages than couples over 55.

US tariffs: here are the Italian wines most at risk, from Pinot Grigio to Chianti Classico

US tariffs: here are the Italian wines most at risk, from Pinot Grigio to Chianti Classico "With U.S. tariffs, buffalo mozzarella will cost almost double. We're ruined." The outburst of an Italian chef in Miami

"With U.S. tariffs, buffalo mozzarella will cost almost double. We're ruined." The outburst of an Italian chef in Miami "With US tariffs, extremely high risk for Italian wine: strike deals with buyers immediately to absorb extra costs." UIV’s proposal

"With US tariffs, extremely high risk for Italian wine: strike deals with buyers immediately to absorb extra costs." UIV’s proposal Meloni: "Tariffs? If necessary, there will be consequences. Heavy impact on agri-food sector"

Meloni: "Tariffs? If necessary, there will be consequences. Heavy impact on agri-food sector" The Government honours the greats of Italian cuisine, from Bottura to Pepe. Massari: "Thank you, Meloni, the only one who listened to us"

The Government honours the greats of Italian cuisine, from Bottura to Pepe. Massari: "Thank you, Meloni, the only one who listened to us"