An increase in fan bases and in-person events, the consolidation of Instagram, the rise of LinkedIn among social media platforms, good communication about food-wine pairings, but a decline in the quality and quantity of information available on websites and still underdeveloped e-commerce. There’s little cause for celebration when looking at how major wineries engage with the web.

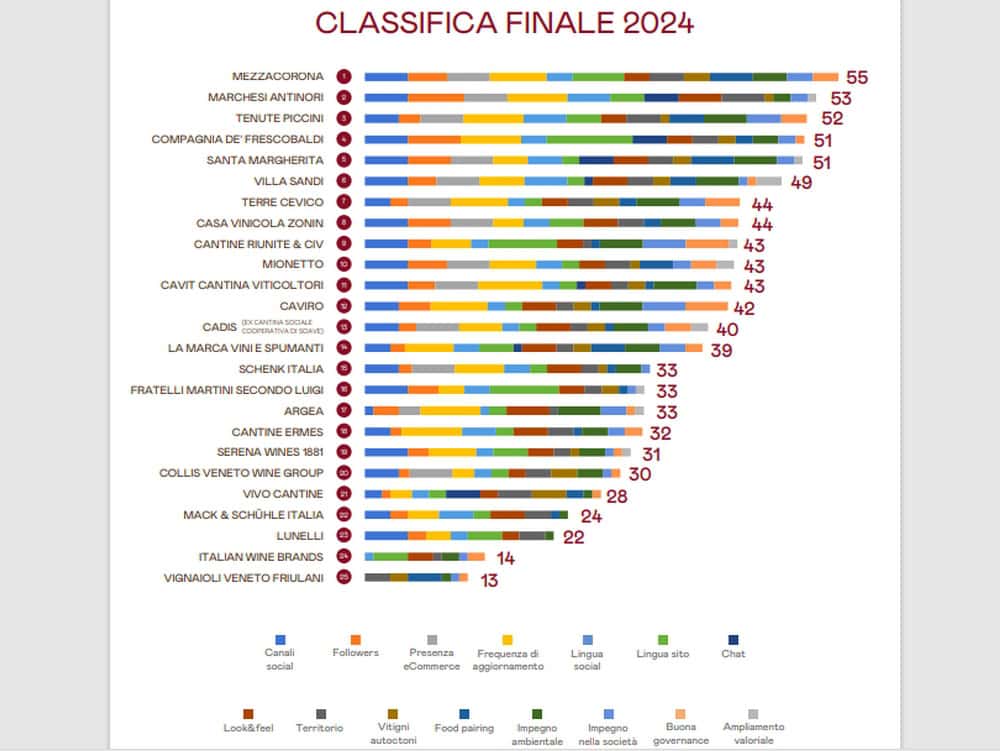

The 11th edition of the study The Digital Taste of Italian Wine, curated by Omnicom PR Group Italia, examines the online presence of Italy’s top 25 wineries by revenue (as listed by Mediobanca). It highlights some improvements, unveils emerging trends such as interest in de-alcoholised wines, but also underscores the work that remains to be done for the future. The rankings (see graph below) show consistent leadership by Trentino’s Mezzacorona, followed by two Tuscan wineries: Marchesi Antinori and Tenute Piccini.

Decline in trust for E-shops

Starting with sales and online presence, the news is less encouraging. The 2023 analysis recorded 13 wineries with online shops (a stable figure compared to 2022), while the 2024 report shows a drop to 12 out of 25. Furthermore, despite brands aiming to accompany users through various stages, the user experience is deteriorating. According to the report: “Despite updates, the experience remains insufficiently advanced, limited to product presentation and purchase processes, without expanding consumer engagement.”

Social media: LinkedIn on the rise

The analysis of major wine brands’ social media presence is similarly underwhelming, though LinkedIn is gaining traction. 21 wineries out of 25 are now on LinkedIn, up from 20 in 2023, with an aggregate follower increase of over 13% compared to 2023. Social media is mainly used to present companies, highlight professionals linked to the product, and promote initiatives.

Instagram’s fan base grew modestly, with a 6% increase compared to 2023 (down from +28% in 2023 compared to 2022). 21 out of 25 wineries have an official account (compared to 20 in 2023). Facebook saw a slight decline in followers, down 0.9%, following an 8% drop in 2023 compared to 2022.

YouTube remains underutilised, with 18 wineries active, down from 19 in 2023. Only 10 wineries use X (formerly Twitter), a stable figure. Meanwhile, only seven brands (down from nine a year ago) maintain a presence on Wikipedia, which is valuable for search engine positioning (SERP - Search Engine Results Page). Finally, TikTok saw growth, with six wineries active compared to five the previous year.

In-person activities triumph

Online experiences have been set aside in favour of in-person activities. Fifteen out of 25 wineries (60%) offer wine-related experiences and organise events and gatherings. These include musical festivals and initiatives to engage younger audiences; charity evenings supporting care centres or hospitals; and sporting activities like horseback vineyard tours or yoga lessons among the vines.

Fifteen out of 25 wineries (up from 14 in 2023) feature sections dedicated to tasting tours (compared to 52% in 2020 and 2019) or experiential activities. These range from themed picnics to workshops and special events. The most innovative wineries leverage their hospitality facilities (five restaurants, two accommodations, one museum) and have developed digital pathways with podcasts or even created dedicated cosmetic lines.

English, German, and Chinese Most Common Languages

Besides Italian, English (24 out of 25 wineries), German (10 out of 25), and Chinese (four out of 25) are the most used languages on winery websites. On social media, 15 out of 25 wineries offer content in foreign languages (up from 14 out of 25 in 2023).

Criticism is directed at messaging platforms, all of which use Messenger. Only seven out of 25 wineries responded to information requests within 24 hours, down from nine in 2023 (10 out of 25 in 2021 and 15 out of 25 in 2020), highlighting a declining trend. “The past 12 months have shown a strong return to physical relationships,” explains Massimo Moriconi, General Manager and CEO of Omnicom PR Group Italia. “This is confirmed by a reduced responsiveness in chat communications, as companies increasingly focus on promoting tasting tours and on-site experiences.”

Growing interest in de-alcoholised wines

Nineteen out of 25 wineries (a stable figure compared to 2023) embrace the trend of wine-food pairings, “although the quality and quantity of available information have declined compared to previous years.”

The Omnicom Group analysis also notes an increase in conversations about de-alcoholised wine, “which promises to be a key area to explore for capturing the preferences of new consumers.”

Regarding native grape varieties, 72% of wineries mention them (up from 68% in 2023), with 18 wineries featuring dedicated content on their websites. Some wineries go beyond mere mentions to provide detailed descriptions of grape varieties and their choice of specific grapes.

Strong Commitment to Sustainability (ESG)

Attention to sustainability and ESG (Environmental, Social, and Governance) themes remains strong. 23 out of 25 wineries (down from 24 in 2023) highlight projects to protect grape varieties and their biodiversity and control fertiliser and pesticide use.

Websites also include information on proper recycling of bottles, caps, plastics, and packaging, as well as on renewable energy use and collaborations with local entities and institutions for certifications or conservation projects.

Italian wineries are also addressing social aspects: 22 out of 25 (up from 19 in 2023) are increasingly sharing initiatives on good governance practices, with 19 out of 25 (compared to 18 in 2023) communicating organisational models that ensure innovation, local spirit, ethical supplier selection, and fair employee treatment (contracts and salaries). However, issues of inclusivity and diversity, as well as power balancing, remain absent.

Below is the 2024 ranking of the 25 wineries analysed.

source: Il gusto digitale del vino italiano - Omnicom Pr group Italia - 2024

Fewer bottles, more by-the-glass: how to build the wine list of the future

Fewer bottles, more by-the-glass: how to build the wine list of the future The Moncaro collapse impacts Marche wines. But average price rises

The Moncaro collapse impacts Marche wines. But average price rises Trump’s first trade war cost Americans $27 billion. USDA analysis

Trump’s first trade war cost Americans $27 billion. USDA analysis Here are ten Rare Wines you absolutely must try

Here are ten Rare Wines you absolutely must try The “Tariff Vinitaly” closes with 97,000 attendees: one third from abroad. See you on 12 April 2026

The “Tariff Vinitaly” closes with 97,000 attendees: one third from abroad. See you on 12 April 2026