In a few days, Italy's 2024 wine export data from Istat will confirm that a new record has been set, proving that Made in Italy wine is crisis-proof and that previous concerns were unfounded. For a moment, we will even forget about Trump’s tariffs, as another (wooden?) medal will be pinned on Italian wine, which is set to approach €2 billion in sales. You don’t need a crystal ball to predict the headlines we’ll see on March 11 (the big day): “Forget Trump—Italian wine leads the triumphant charge in the US, a country that loves Italy and cannot give up its products.” But is that really the case?

A rush of orders driven by announced tariffs

We tried to understand what is actually happening, starting with the United States, where two unpredictable variables are reshuffling the deck and upending the game. The first concerns the tariffs announced by Trump, which could take effect from April 2. The second is numerical: the positive trend in wine imports clashes with actual consumption data, which shows a significant decline. But let’s take it step by step.

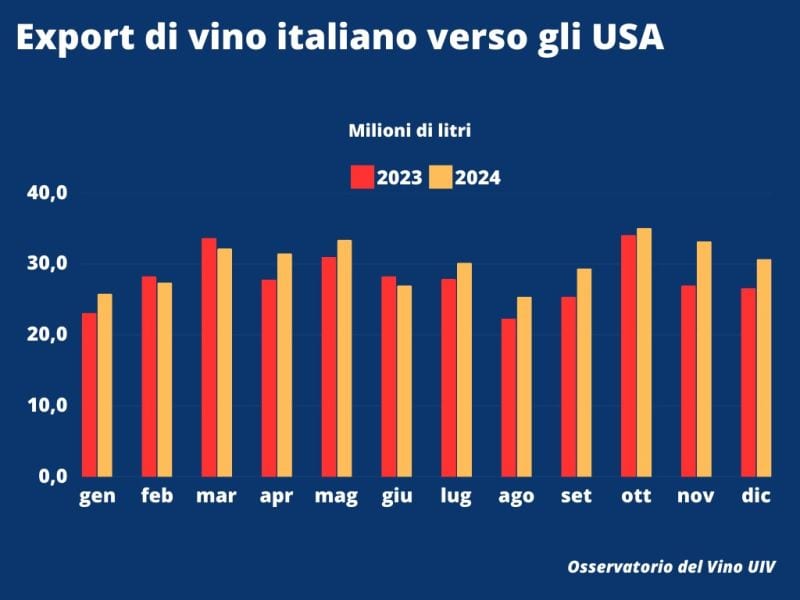

It is true that the world’s leading wine market will close 2024 with an approximately 10% increase in orders. However, this growth is largely due to the final rush by American importers to get ahead of the potential tariffs—November and December alone saw an average growth of +20%. And in January, shipments to the US continued to soar, as the only quick way to counter tariffs is to preempt them.

Italian wine export to the USA

However, the Secretary General of Unione Italiana Vini, Paolo Castelletti, warns: “The analysis of the US wine market’s performance cannot ignore the fact that it is artificially inflated by the tariff scare. What is certain,” he added, “is that in the coming months, there will be a reckoning regardless of the potential new tariffs, because domestic consumption is showing a clear downward trend.”

Proof of this is the news that one of the world's leading beverage groups, Constellation Brands, is looking to sell its wine portfolio, while major distributors—including Southern Glazer’s—are implementing drastic staff cuts.

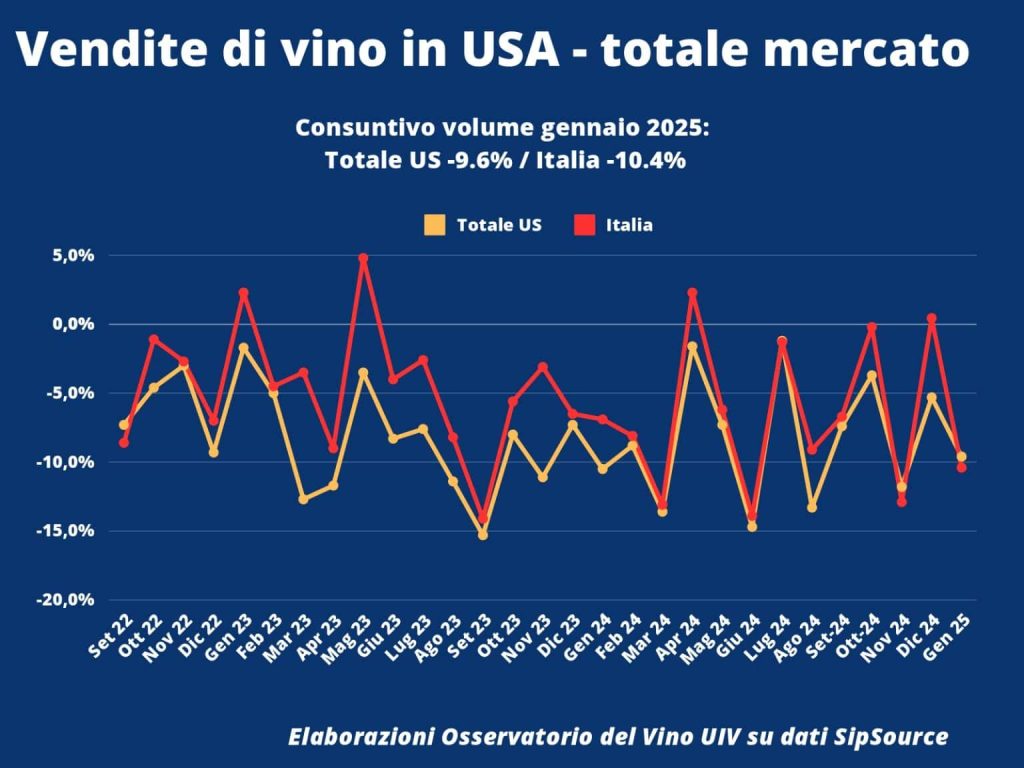

US wine consumption plummeted in January

On the flip side, by December, unsold alcoholic beverages stockpiled in American distributors’ warehouses had reached nearly $10 billion in value. According to the Unione Italiana Vini's SipSource-based observatory, US wine sales overall fell by 9.6%, with Italian wines down 10.4%. So, while exports have surged, domestic sales (and real consumption) have been in steady decline for two years.

“In a market where actual consumption is worse than in 2023, where will all this wine end up?” wonders Carlo Flamini, head of the UIV observatory. “By 2025 (or maybe even later), this issue will likely come back to bite us.”

Wine sales in the USA - total market

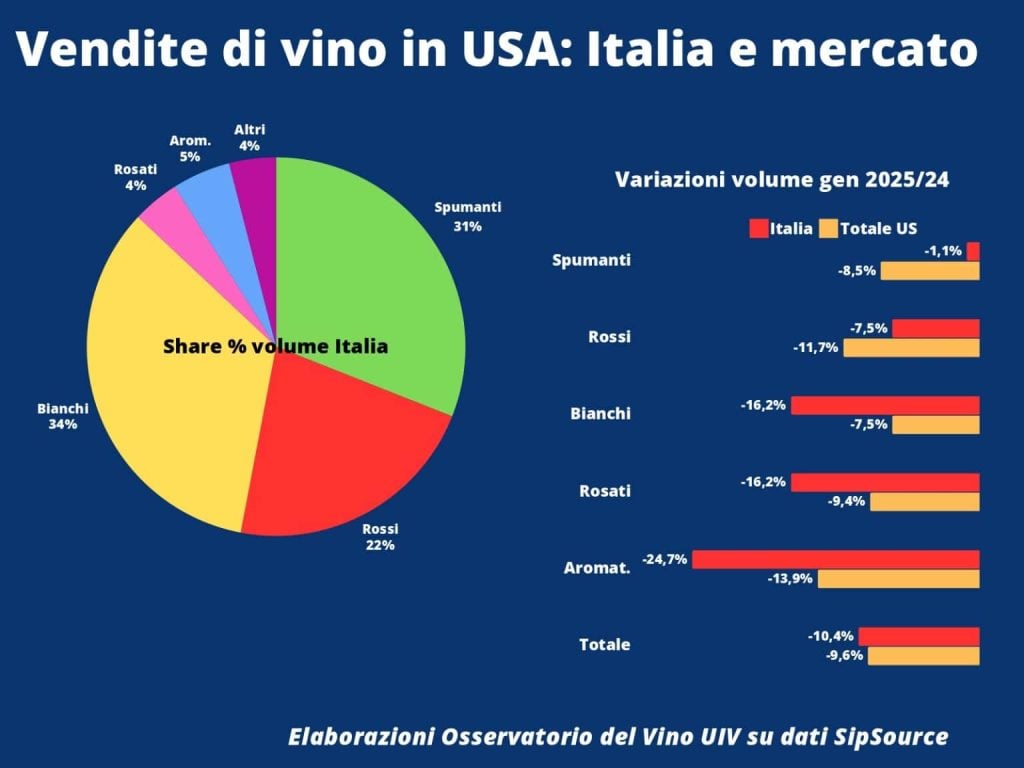

Even Prosecco is down: -7.1%

This time, even Prosecco has not been spared, dropping by 7.1% in January. However, the sparkling wine category limited its losses to -1.1% thanks to Charmat-method wines. In fact, Charmat wines were the only segment to show positive figures, compared to the declines seen in domestic sparkling wines (-14%), French sparkling wines (-12.4%), and Spanish sparkling wines (-8.4%).

Italian red wines also took a hit, closing the first month of the year at -7.5%, while white wines plummeted by 16.2%. Double-digit declines were also recorded for rosé and aromatised wines.

Looking at specific denominations, significant declines were noted for Pinot Grigio delle Venezie, Sicilian DOC wines, Valpolicella, and Moscato d’Asti. However, Tuscan wines held steady, with a notable rebound for Chianti Classico.

Wine sales in the USA - Italy and market

The call to work on free trade agreements

The continued decline, following last year’s downturn, should prompt reflection on how to change course—on the need to better define target audiences, refine and regulate market offerings, and respond to trade restrictions and anti-alcohol lobbying.

“In a world that is closing in on itself, promotional support becomes even more critical,” says UIV President Lamberto Frescobaldi. “These funds have significantly contributed to the nearly 60% growth in our exports over the last decade. Promotional initiatives could help expand the reach of Made in Italy exports, provided we also work—where possible—on new free trade agreements.”

The key word, once again, is diversification: betting everything on the same old markets, especially now, is counterproductive (this applies not just to the US but also to recession-hit Germany).

When protectionism comes back into fashion—even in Italy

“The US market is irreplaceable,” Frescobaldi continues, “but denying the difficulties, which will worsen if tariffs are imposed, is pointless and counterproductive. That’s why, while respecting different viewpoints, opposing bilateral trade agreements—such as the one with Mercosur and now also with India—doesn’t help. You can’t criticise protectionism while practicing it at home.”

A word to the wise...

Coldiretti’s recent appeal to the Italian government to stall the India trade deal (following similar concerns over Mercosur) could spark a clash between industry associations. This comes at a time when Trump’s autarchic economic model is making a comeback.

Ultimately, the decision always comes down to one question: how much are we willing to lose?

Certainly, Coldiretti's appeal to the Government to put the brakes on the agreement with India (following concerns over Mercosur) could become a battleground between industry associations at a time when Trump's autarchic model seems to be making a comeback. The choice always comes down to one question: how much are we willing to lose?

Fewer bottles, more by-the-glass: how to build the wine list of the future

Fewer bottles, more by-the-glass: how to build the wine list of the future The Moncaro collapse impacts Marche wines. But average price rises

The Moncaro collapse impacts Marche wines. But average price rises Trump’s first trade war cost Americans $27 billion. USDA analysis

Trump’s first trade war cost Americans $27 billion. USDA analysis Here are ten Rare Wines you absolutely must try

Here are ten Rare Wines you absolutely must try The “Tariff Vinitaly” closes with 97,000 attendees: one third from abroad. See you on 12 April 2026

The “Tariff Vinitaly” closes with 97,000 attendees: one third from abroad. See you on 12 April 2026