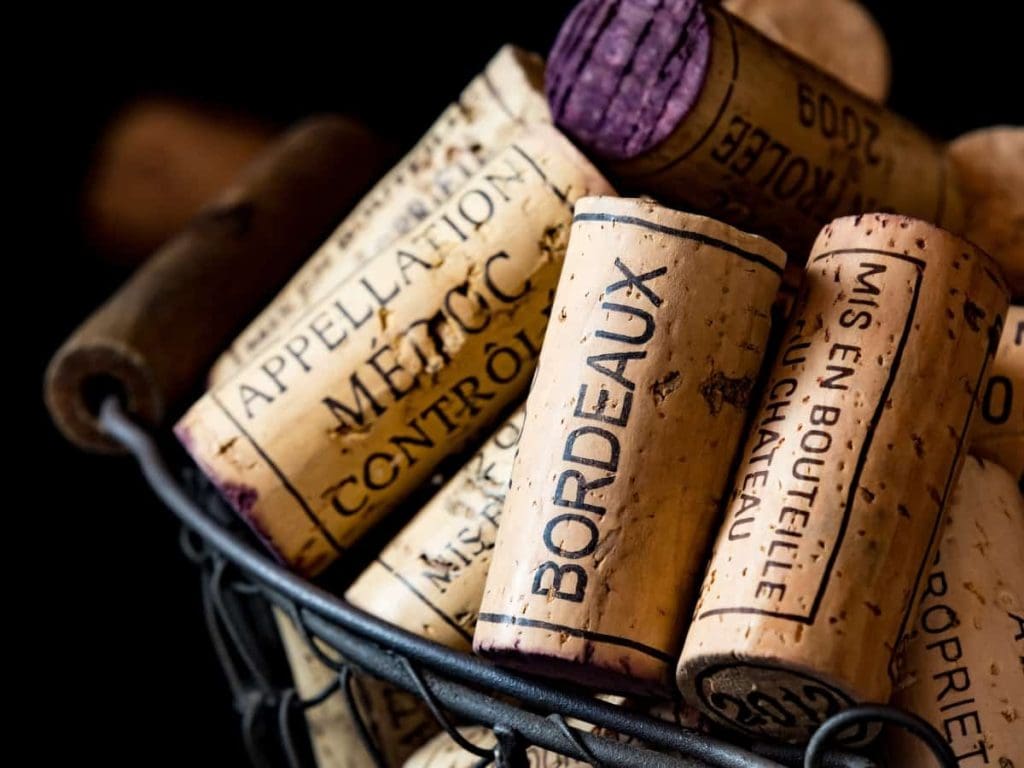

After more than a decade of acquisitions in Bordeaux, many Chinese investors are reversing course. The reasons? Beijing's capital restrictions, declining wine consumption and demand domestically, and an initial underestimation of the costs of managing French estates. These factors have pushed many buyers to make a sudden exit from the French stage.

The symbolic case of Château Latour Laguens

According to Vino Joy News, China has acquired over 200 Bordeaux estates since 2012, including those owned by billionaire Jack Ma, actress Zhao Wei, and Hong Kong businessman Peter Kwok. However, South China Morning Post reports that about 50 Bordeaux wineries owned by Chinese investors are currently up for sale, according to Li Lijuan, a real estate agent and Asian market specialist at Vineyards-Bordeaux.

A striking example of this trend is Château Latour Laguens. The Longhai Investment Group, a Qingdao-based real estate company from Shandong province, purchased the winery in 2008. The investment was made with the belief that the wines would quickly turn a profit by being exported to the Chinese market. However, 16 years later, the property is up for auction at a starting price of just €150,000, excluding the vineyards.

Initially, Latour Laguens benefited from the boom of French wine in China. A Qingdao wine merchant told Vino Joy that the estate enjoyed strong sales through group purchases, high-end distributors, and supermarkets, boosted by Longhai's real estate industry connections. But this rosy picture ended with growing competition in wine imports and a slowdown in the Chinese economy.

Shattered expectations of Chinese investors

Several factors lie behind Chinese entrepreneurs’ change of course. One major reason is Beijing’s decision to impose strict capital controls, which delivered a heavy blow. “The Chinese can no longer invest abroad because their money is stuck in China,” said Li Lijuan.

But it’s not the only cause of this great exodus. Unrealistic expectations also played a significant role in triggering this process. “Some investors,” Li Lijuan explained, “bought properties without considering their financial stability or the future of their investments. They underestimated the management costs of the estates and overestimated the ability to sell expensive wines in an already ‘crowded’ domestic market.”

The collapse of wine consumption in China

Shen Yi, a former executive in the Chinese wine industry, told Vino Joy that many properties faced operational challenges even before being purchased by Chinese investors, who often lacked experience managing vineyards. “Many were attracted by the potential profits from wine but underestimated the industry’s demands and its management challenges. Since these entrepreneurs’ main businesses are based in China, managing overseas wineries effectively has been difficult.”

Additionally, post-Covid, domestic wine consumption in China has plummeted, falling by a quarter in 2023 alone, according to the International Organisation of Vine and Wine. “China’s economic downturn has made matters worse, with wine sales declining. Companies are selling off assets to recover funds,” Shen Yi concluded.

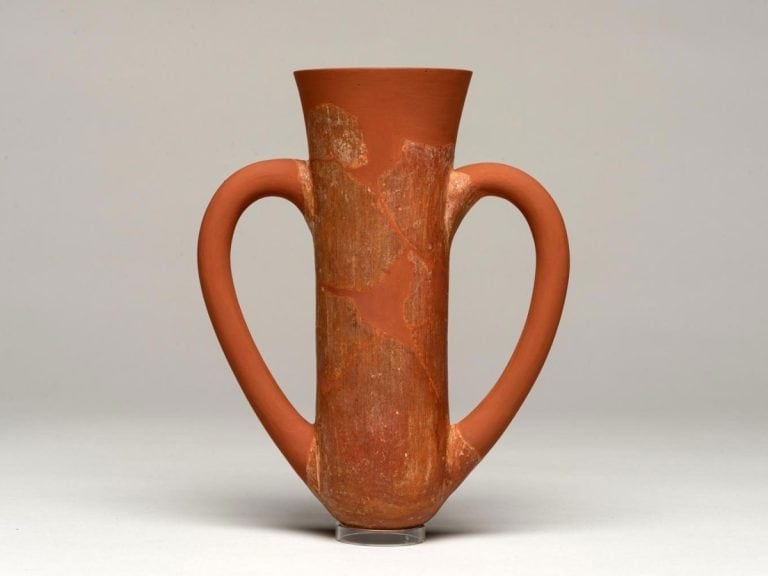

Wine was a drink of the people as early as the Early Bronze Age. A study disproves the ancient elitism of Bacchus’ nectar

Wine was a drink of the people as early as the Early Bronze Age. A study disproves the ancient elitism of Bacchus’ nectar "From 2nd April, US tariffs between 10% and 25% on wine as well." The announcement from the Wine Trade Alliance

"From 2nd April, US tariffs between 10% and 25% on wine as well." The announcement from the Wine Trade Alliance Michelin surprise: in France, the guide rewards Italian chefs

Michelin surprise: in France, the guide rewards Italian chefs Vinitaly 2025: "Piwi should not be included in the DOCs. Dealcoholised wines? I have changed my mind." Angelo Gaja's position

Vinitaly 2025: "Piwi should not be included in the DOCs. Dealcoholised wines? I have changed my mind." Angelo Gaja's position Vinitaly 2025: here are all the events by Gambero Rosso. Tre Bicchieri, debates, TV and much more...

Vinitaly 2025: here are all the events by Gambero Rosso. Tre Bicchieri, debates, TV and much more...