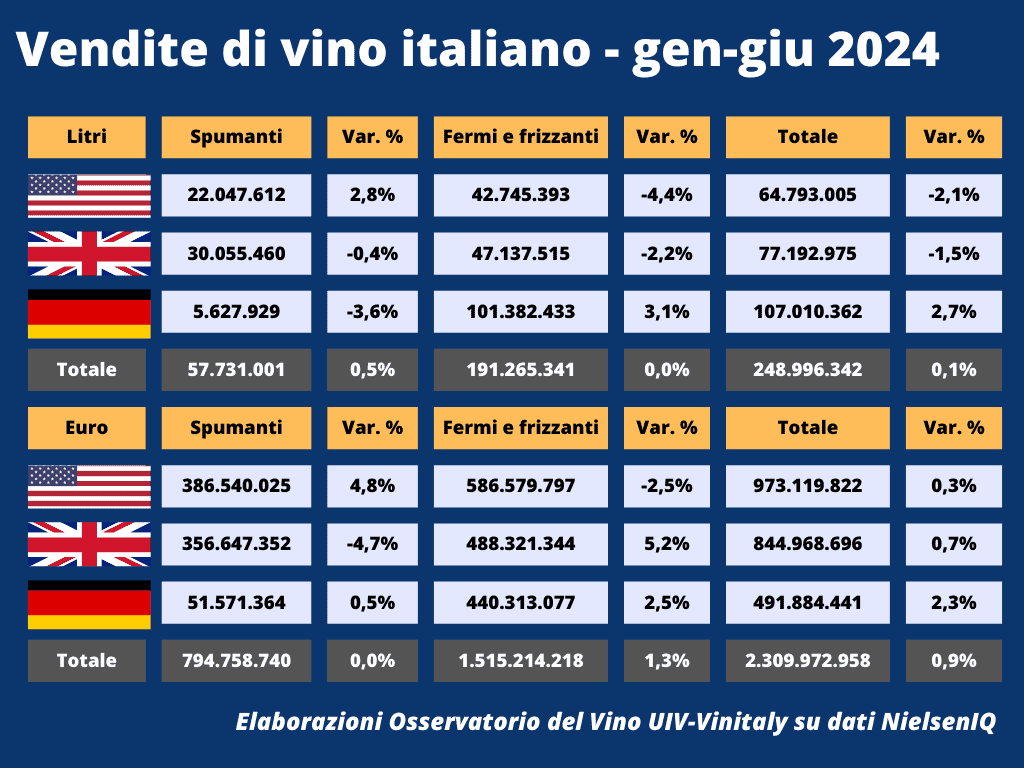

The first half of the year ends negatively for wine in foreign large-scale retail. The main three reference markets – the United States, United Kingdom, and Germany – collectively see a -4.3% volume decrease, with a value of 13.9 billion euros (-1.5%), according to the Uiv-Vinitaly Observatory analysis based on Nielsen-IQ data.

Sales in GDO: Italy fares better than competitors

However, Italian wines on the shelves remain stable with volumes at +0.1% and a value, still influenced by inflation, of 2.3 billion euros (+0.9%). Compared to March, the Observatory notes a worsening situation felt almost everywhere due to a plummeting second quarter (volumes at -4.3%) and a consequent decline in demand for Italian wine in the USA (-2.1%) and UK (-1.5%), but not in Germany (+2.7%), decisively supported only by low-cost sparkling wines.

In the USA, one in four bottles is Prosecco

In the States, where Italian wine stops at 973 million euros in the first half, sparkling wines remain in the green (+2.8%), while still and semi-sparkling wines register a -4.4% volume and -2.5% value decrease. Therefore, it’s unsurprising that one in every four bottles of Italian wine in US shopping carts is Prosecco (+4.3%). The incidence of North-East sparkling wines is even higher in the UK, at 33%, but the heavy second-quarter downturn affected the UK's mid-year results for both sparkling (-0.4% volume and -4.7% value) and still wines (-2.2% volume and +5.2% value), for a total of 845 million euros. Finally, in the German market, Italy limits the damage of an otherwise stagnant market thanks to the “frizzantini”boom (+23.3% volume and +14.6% value), aided by a bargain average price: 3.63 euros/litre (-7% the average price).

Italian versatility as an anti-crisis weapon

The trend on the shelves shows a contraction in consumption, but overall, Italy can rely on some strong points, as revealed by Unione Italiana Vini president Lamberto Frescobaldi: "The greater versatility of our products has allowed us to suffer less than competitors from a reduction in consumption that is becoming increasingly evident. But – he adds – a modern vineyard requires equally current managerial choices." Here, the association head returns to a topic addressed in recent days: "The near future of Italian wine will necessarily have to involve yield control and a more precise analysis of markets and consumers, who have never been as fluid as today."

The complete guide to contemporary Cafés in Turin

The complete guide to contemporary Cafés in Turin "I wake up every morning with the idea that I don't know how to cook." The chef who enchanted New York with a restaurant without a menu

"I wake up every morning with the idea that I don't know how to cook." The chef who enchanted New York with a restaurant without a menu From the Metropolitan Pavilion to the Top Italian Restaurant: Gambero Rosso showcases Italian wine in New York

From the Metropolitan Pavilion to the Top Italian Restaurant: Gambero Rosso showcases Italian wine in New York The 14 best-value Pinot Noir wines among reds, rosés, and sparkling wines chosen by Gambero Rosso

The 14 best-value Pinot Noir wines among reds, rosés, and sparkling wines chosen by Gambero Rosso One of the best Pinot Bianco wines from Friuli Venezia Giulia is made by a former Bbnker. Here’s which one

One of the best Pinot Bianco wines from Friuli Venezia Giulia is made by a former Bbnker. Here’s which one